Sep

25

Choosing between the mobile wallet types: Proximity versus remote

For the past several weeks, we’ve been looking in detail at mobile wallets. We have defined the mobile wallet, described different types (proximity and remote, umbrella and integrated), detailed the services and functions, illustrated user scenarios, talked about analytics and looked at the wireless technologies. By now you are probably wondering what type of wallet you should use to deliver your services to customers. How do you know whether a proximity or remote wallet is best?

Based on my experience from many projects in different industries, there is no favored mobile wallet concept that fits all wallet requirements. Indeed, there is confusion in the market as requirements overlap with the different wallet concepts. Let’s look at some examples.

Proximity or remote mobile wallet?

Mobile payments

The remote wallet is the logical initial approach for remote or e-payments scenarios, and the proximity wallet for proximity payments, when the payment is initiated through a point-of-sale (POS) payment terminal.

For remote wallet providers, like PayPal, the next expansion step is moving toward payments in physical stores. This requires a proximity payments approach based on either exchanging information through a visual digital valuable like QR code or through NFC card emulation (that’s near field communication). On the other side, many card issuers start with a proximity wallet approach but soon realize that their card should also be used in remote and e-payments scenarios, both of which are not covered in the proximity wallet concept. So for payments, neither type of mobile wallet can fully cover all payments use cases.

Mobile ticketing

For storage of a mobile ticket, which is a digital valuable for a proximity authorization with a ticket conductor or a gate access terminal, a proximity wallet container is required. However, the purchase of a mobile ticket is a typical remote scenario. The ticket can be bought and issued anywhere using an e-payment transaction and hence requires a remote wallet approach for payments.

Coupon redemption

Coupons are stored in the proximity wallet container and are mainly considered for redemption in proximity scenarios. However, they should also be applicable in remote payments scenarios and in combination with loyalty cards, which could be stored in remote wallets.

So which of the mobile wallet types is the best fit?

These examples clearly show that the requirements and usage scenarios for proximity and remote wallets often overlap. In fact, this often becomes visible only after a wallet vendor first launches its mobile wallet and enables added-value functions for it. It could even turn out that such value-added functions are fundamental to the business case of the wallet but require a different wallet concept than the implemented one.

Choose both mobile wallet types from the beginning

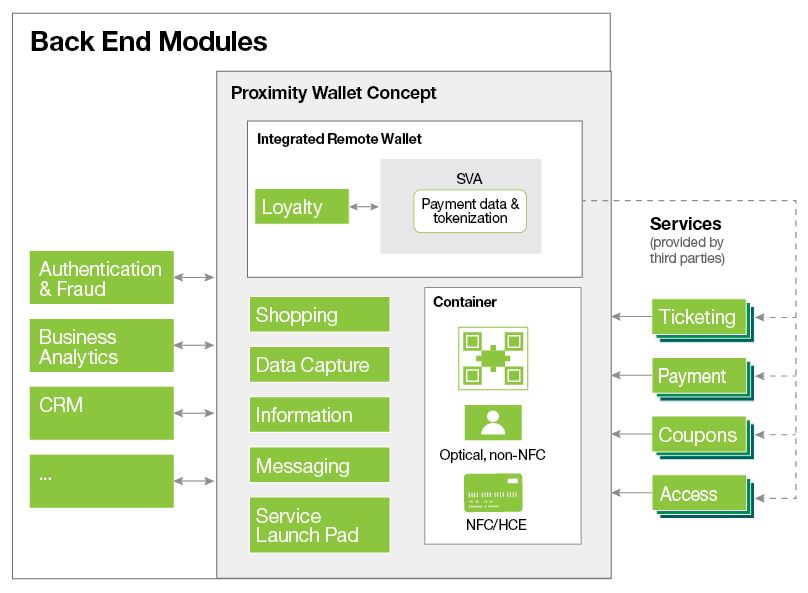

Due to these challenges and risks, I recommend that you consider both wallet concepts right from the beginning in your strategic solution design and roadmap planning. You might arrive at a clear decision for one of the wallet concepts considering your specific long-term requirements. Or you might choose a hybrid wallet concept to combine the best of both worlds. With a hybrid approach, you can set up core functions like identification, analytics and security modules that are reusable in both wallet concepts. The following illustration shows a hybrid wallet concept developed by IBM with a remote wallet that is integrated into a proximity wallet.

mobile wallet types

In this hybrid mobile wallet concept, the wallet contains a central stored-value account (SVA), either hidden or exposed to the users, which can be used as a payment method in remote payment scenarios. A transaction is debited using the wallet’s SVA account, which is connected to the payment services of third-party payment service providers. For proximity payment scenarios, either the transaction is directly passed through to the third-party payment service through card emulation, or, optionally, a new payment process can be established through the wallet’s SVA account.

Presuming that you use a hybrid approach, there are still more decisions to be made. In my next post, I’ll talk about further options between types of proximity wallets: a light wallet and a full wallet with NFC card emulation.